We want to bring to your attention the increasing prevalence of phone scams and provide you with essential tips to safeguard your finances and personal information.

How Phone Scams Work:

Scammers often pose as representatives from legitimate organizations, including financial institutions, government agencies, or even tech support teams. They use persuasive tactics to extract sensitive information such as your account numbers, Social Security numbers, or other personal data.

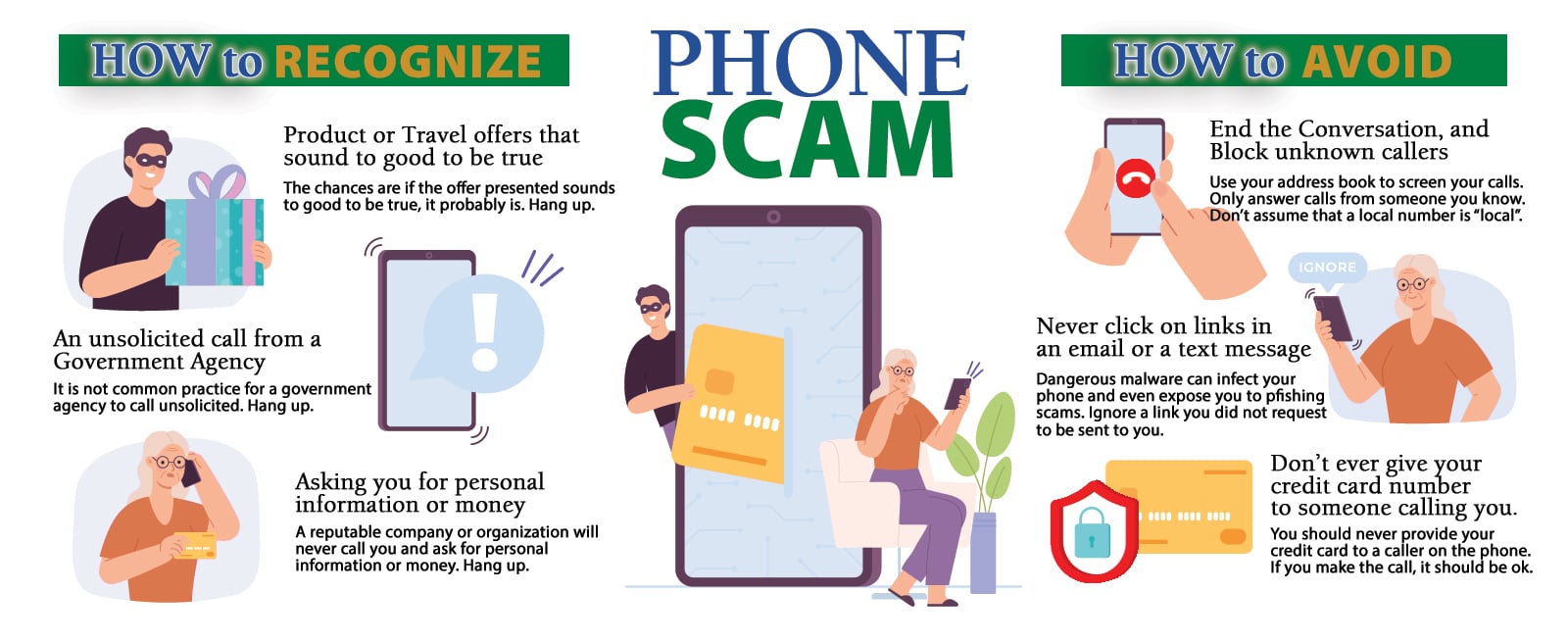

Key Signs of a Phone Scam:

- Urgent Requests for Personal Information: Legitimate organizations will never ask for sensitive details like PINs or passwords over the phone.

- Threats or Intimidation: Scammers may claim dire consequences if you don’t comply immediately.

- Requests for Money Transfers: Be wary of any demands for wire transfers, gift cards, or other forms of untraceable payments.

How to Protect Yourself:

- Verify the Caller: If you’re unsure, hang up and call back using a number you trust, such as the number on the back of your card or on our official website.

- Guard Your Information: Never disclose personal information unless you initiated the call and are confident about the recipient’s identity.

- Stay Informed: Keep up-to-date with the latest scam trends. Often, scammers follow similar patterns, and knowing these can help you recognize fraudulent attempts.

If You Suspect a Scam:

- Contact Us Immediately: If you receive a suspicious call regarding your Heartland Area Federal Credit Union account, please let us know right away.

- Report the Scam: Inform local authorities and consider reporting to the Federal Trade Commission at www.ftc.gov/complaint.

- Your security is our top priority. Together, we can work to keep your information safe and prevent these scammers from succeeding.

For more details, reach out to our customer service team. Take advantage of this special offer and enjoy a little extra financial freedom this month!